Of many clients inquire in the event the there are financial obligation-to-money conditions that have USDA home loan financing. The newest short answer is sure. The debt-to-money proportion are a qualifying grounds for a great USDA home loan. T

the guy standard recommendation can be your personal debt-to-earnings proportion ought not to surpass 43% of one’s adjusted revenues. Even though it is payday loan near me you’ll be able to commit over it matter, it does all be the main automated underwriting program to find out if your qualify for good USDA mortgage.

Gustan Cho Partners offers a straightforward-to-have fun with financial calculator to help you estimate their front and back-end financial obligation-to-money ratios. GCA’s affiliate-friendly financial calculator gives you an estimate in your mortgage fee.

Tens of thousands of watchers use the GCA financial calculator. The fresh GCA financial calculator can be used because of the financing officials, real estate agents, and individuals regarding the real estate industry.

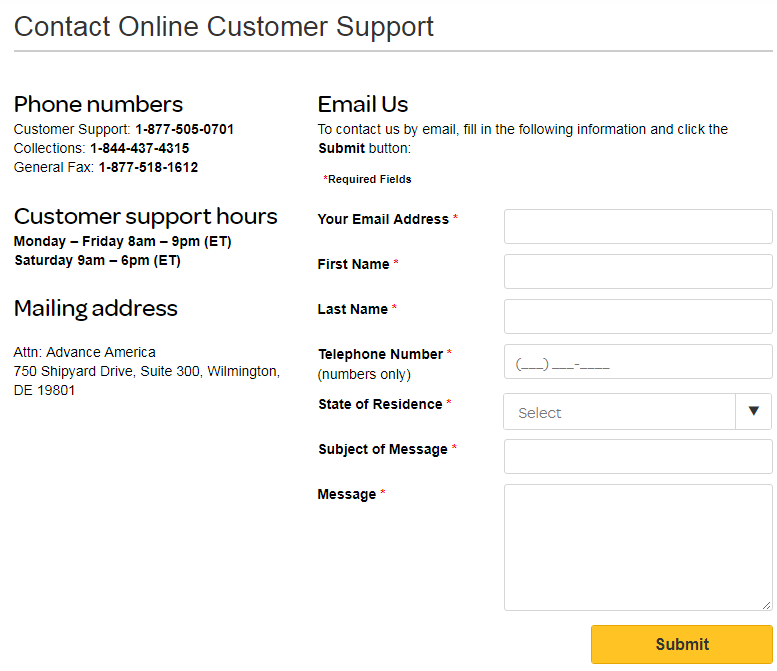

For issues with the making use of the condition-of-the-art mortgage calculator, please contact us in the Gustan Cho Partners from the (800) 900-8569 now. Text message us having a quicker reaction. Brand new USDA home loan calculator offers an industry where you could enter into almost every other debts such as your bank card payments, auto loan money, student education loans, and every other financial obligation you’ve got reported with the borrowing from the bank statement.

Do Loan providers Enjoys Different USDA Mortgage Standards

For those who have less-than-best borrowing from the bank or higher loans-to-earnings rates, you must work at a highly skilled mortgage people you never know new particulars of an excellent USDA mortgage loan. Not absolutely all loan providers have a similar credit conditions on the USDA fund.

USDA Home loan Criteria towards the Fico scores

Credit history Credit rating can be hugely difficult to understand. This new USDA automated underwriting program generally desires pick a credit get regarding 640 or more. However, to acquire a house that have a great USDA mortgage loan is possible also should your credit score are lower than 640.

If for example the credit rating is actually above 640, this new automated underwriting system having USDA money commonly generally speaking send you an approval.

While many situations enter into a great USDA real estate loan, a credit score is extremely very important. Gustan Cho Associates is obviously offered to remark your credit score in detail. We have been specialists in credit scoring and certainly will make you recommendations to boost your credit rating to help you be eligible for a good financial.

USDA Fund Having Less than perfect credit

We come across all the credit rating on the mid-400s on the mid-800s. There are many little things you can do to improve their credit history. Our team is here giving the qualified advice. While we never highly recommend credit resolve, we have been usually happy to advise you to your raising your credit ratings. Borrowers that have bad credit can also be qualify for USDA fund.

Generally speaking, for those who have bad credit and lower credit ratings, just be sure to reveal almost every other compensating points. Instance of compensating points take-time commission background, a lot more possessions about bank, durability on your own work, and you can high continual earnings..

Perks To help you a beneficial USDA Financial

In our opinion, ideal perk so you can a good USDA mortgage ‘s the zero down payment requirement. On economic condition the united states is now in the, saving cash try more challenging than in the past. That have inflation greater than from inside the ericans are consuming owing to the discounts simply to pay the bills.

USDA Financial Requirements on the Advance payment

As a great USDA financing doesn’t need a down payment and lets owner to pay settlement costs, to buy property with little if not no cash regarding pocket is achievable. A beneficial USDA mortgage loan will allow the seller to blow upwards to help you six% of the price toward merchant-paid down closing costs.